Taxes.

Seeing as how Blair had staff duty (a 24 hour shift) yesterday, I had prepared a huge To Do list of things to accomplish. I wanted to get a blog post up, deep scrub the bathroom, reorganize our bedroom closet, maybe take Costello for a walk and get our taxes done. Since I’ve had busier days before, I thought I would be able to pound these things out without a doubt. However, as the day quickly came to an end, I found myself hitting my head against our dining room table out of frustration.

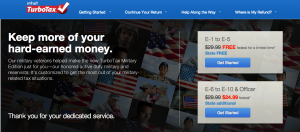

TurboTax Military Edition is free for E1-E5’s!

The day had practically gone as planned until I sat down to do our taxes. Now I’m not too sure if this is embarrassing for me to say or not, but this was my first time actually filing taxes. Before I had always been claimed as a dependent or asked my Dad to file my taxes for me (BTW, thanks Dad!). I had not only watched him file taxes before, but also several other family members – and every time it seemed to be just as easy as “1 – 2 – 3”.

I’m not a number kind of person, but I figured that all I was essentially doing was “copy and pasting”. However, I didn’t take into account how much filing as a newly married military couple would confuse me – and it did just that and more. Again, embarrassingly, I felt like I was having a complete mental breakdown all thanks to filing taxes.

To give you a little bit more background info, I was using TurboTax’s Free Military Edition for (ranks) E-1 to E-5. After doing a little research, I found that there were several different places that would do our taxes for free or had a free diy tax filing program. At Fort Lewis, there is the Tax Center or the H&R Block At Home Online tax preparation is available too, but I found that most people find TurboTax’s edition to be better when it came to getting more tax refunds. And, hey, who doesn’t like more money?!

But here are some Important Things to Know Before Filing Your Military Taxes!

1. Know your Home of Record. In our case, it is actually Blair’s Home of Record because he is the active duty enlisted one. Typically, the Home of Record is going to be the state you lived in when you joined the military – a.k.a. state of residency. So despite currently living in Washington, Nevada is his Home of Record.

*If you aren’t sure, check his LES (Leave and Earning’s Statement) through mypay.gov.

2. Understand and decide whether you will use the Military Spouses Residency Relief Act. This relief act allows military spouses to claim their active duty spouse’s state of residency even if you have PCSed to another state. For me it made sense to keep my residency in Nevada – state taxes are considerably lower there!

3. Make sure you are keeping track of what you can write off! While many of the tax write offs out there for military service members, veterans and their families may not apply to your life, sometimes they do! So always make sure to do your research to see what is out there! Currently there are tax write offs associated with PCSing costs, uniform costs and more.

*So, Army wives, start keeping all of your receipts associated with any personal military spending right now!!! Next year you’ll be able to add up what you spent out of pocket for things like uniforms. Just make sure you don’t include the uniforms they buy using their annual uniform allowance!

4. Take advantage of the free tax programs out there. Even though I had a difficult time doing ours to begin with, as long as you know and understand terms such as Home of Record and Military Spouses Residency Relief Act, you are set. Why pay when something free is available to you, right?

5. Do your research and be prepared. In the end, I wasn’t able to finish our taxes because I hadn’t done this step. While I had all of Blair’s W-2 information (Army makes this super easy to access through mypay), I didn’t have mine… Major Fail. 😦

*Just so you know, your employer actually has till the end of January to send out W-2’s! Also, 2013’s Tax Deadline is Monday, April 15th!

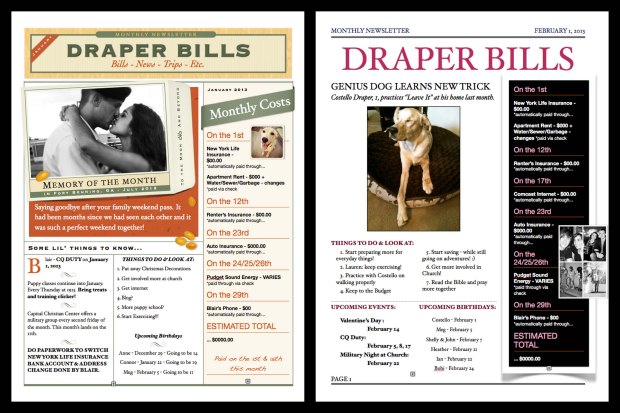

Despite not clicking the send button on our taxes yet, I still found myself having a productive day, even after all of the frustration and stressing. And to calm myself down after this fiasco, I got a little crafty/organizational and created February’s Draper Family Newsletter. Now it may seem cheesy, but it is oh so helpful for me – and it was the perfect way to end my day filled with taxes!

Lauren